Like every other industry, real estate is not exempt from adversity. Accounting for real estate transactions has its complexities that range from the tracking of accounts, to profit and loss allocations, as well as the infamous struggle of taxation.

Accounting inconsistencies can have devastating consequences that include ethics violations, tax penalties, and a decline in a real estate firm’s profits.

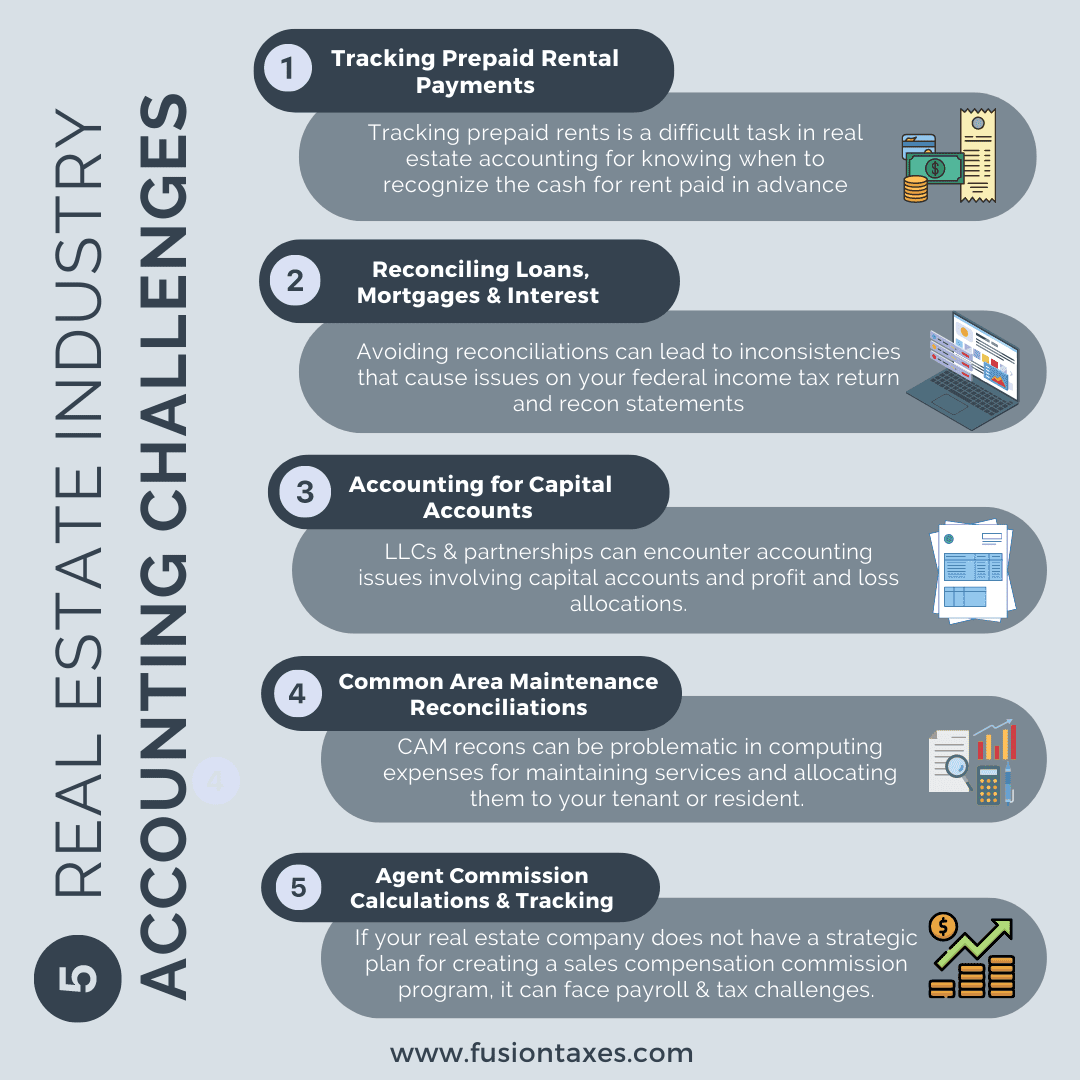

While the industry faces numerous accounting challenges, there are five most common among agents, entrepreneurs, property managers, and other professionals. But you can mitigate most issues associated with recording and reporting, despite your busy schedule and overseeing the management team. When handling the accounting of real estate companies, these are the most common challenges to be aware of:

1. Tracking Prepaid Rental Payments

Tracking prepaid rents is a difficult task in real estate accounting for knowing when to recognize the cash for rent paid in advance. This ties directly into the accounting method a real estate business uses. It is important to understand how to account for advance rent payments and keep the method consistent throughout. Using different accounting methods i.e. cash-based accounting for some, and accrual accounting methods for others will only cause a mess in your accounting which could lead to challenges with the IRS.

Getting your accounting software set up in a way that will track and process early and timeous payments correctly will help maintain the validity of your financial statements and tax reports.

2. Reconciling Loans, Mortgages, and Interest Payments

The reconciliation process of loans, mortgages, and interest payments is challenging without the expertise in comparing transaction balances. Property owners can run into various problems when they neglect to reconcile accounts to correct errors in financial statements. Avoiding reconciliations can easily lead to inconsistencies that cause issues on your federal income tax return, balance sheet, and income and cash flow statements. This is something that you should remember to include in your accounting software set up, to make the intricacies of this loan recons easier as a realtor.

3. Accounting for Capital Accounts & Tracking Owners’ Finance Allocations

Limited Liability Companies (LLCs) and partnerships can encounter several real estate accounting issues involving capital accounts and profit and loss allocations. Under the operating agreement or contract between owners and partners, you must distribute profits and losses based on the percentage of members’ ownership. Accounting for capital accounts among owners of a real estate firm can be a challenge. Allocating profits and losses of business for owners and partners when the agreement is not factored into the accounting setup can create complexities. Miscalculations of capital accounts also lead to misallocations of tax benefits.

4. Common Area Maintenance (CAM) Reconciliations

Real estate managers and entrepreneurs may experience challenges reconciling CAM or Common Area Maintenance items of properties. CAM reconciliation processes are problematic in computing expenses for maintaining services and allocating them to your tenant or resident. These expenses are additional to rent and have tax implications if not reported as income to the Internal Revenue Service. Property managers and owners must reconcile costs of shared expenses accurately against the costs projection in the budget. Shared CAM costs may include:

- janitorial services,

- trash cans,

- furniture,

- washer and dryer,

- parking lot, and

- security.

5. Agent Commission Calculations and Tracking

Calculating and tracking real estate agent commissions is a common challenge in the real estate industry. If your real estate company does not have a strategic plan for creating a sales compensation commission program, it can face payroll and tax challenges. While the flat formula has a constant rate and is easier to calculate, the variable calculation is more complicated because the rate fluctuates. For agents, their commission rate is the percentage of business brought to a real estate company which may be challenging with up and down fluctuations – and this impacts monthly recons. It should be made provision for in your accounting software.

Real estate accounting has its challenges, our CPAs have years of experience and can help you face those challenges head-on with the proper accounting software setup and the accounting tools you need to track and report capital and accounts.

View this article at a glance, here:

__________________________________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.