Like any other industry, healthcare is not exempt from challenges. But, the COVID-19 pandemic has highlighted and sped up some of the pain points this industry faces.

Ranging from fast-evolving government regulations affecting the operations of medical facilities to a demand for technological innovations that can alleviate both operational and administrative inadequacies, the healthcare industry faces a number of major challenges.

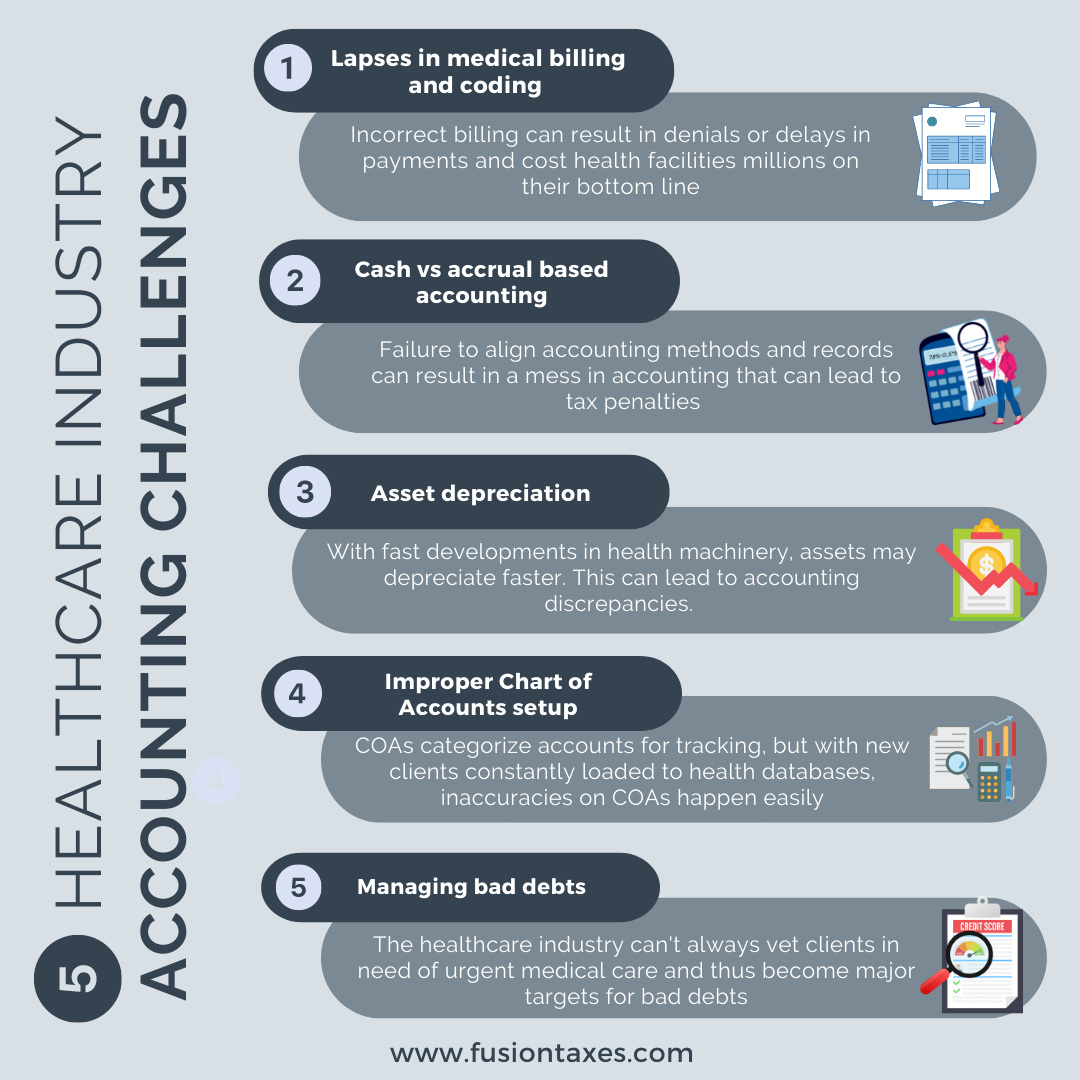

1. Lapses in medical billing and coding

One of the most common issues the healthcare industry faces relates to errors and improper coding for medical claims. This can be linked to a miscommunication between billing staff and healthcare practitioners, who may, due to high-pressure environments fail to provide sufficient information noting every medical item used when performing procedures. Billing staff who do not properly link diagnosis codes to the Current Procedural Terminology may contribute to incorrect billing, which can result in denials or delays in payments and cost both smaller and larger health facilities millions on their bottom line.

2. Cash vs Accrual based accounting

Healthcare accounting follows generally accepted accounting principles (GAAP), which recommend accrual-based accounting for healthcare providers.

The accrual accounting method recognizes and reports income in the year it was earned, regardless of payments not received, and deducts expenses when incurred. While the cash-based accounting method, reports income during the receiving year and deducts expenses when paid in that year.

The challenge for the healthcare industry is that late payments and queried accounts will result in payments showing on the bank statements long after the period in which it was recorded. Having accounting software in place that can manage these inconsistencies is imperative to the financial outlook, accuracy, and tax filing process of healthcare facilities. Failure to align these records can result in a massive mess in accounting and possibly lead to tax penalties if not dealt with correctly.

3. Asset depreciation

Depreciation spreads the expense of a fixed asset over the years of the estimated useful life of the asset. Depreciation expenses write down the value of a fixed asset over time so that asset values are appropriately represented on the balance sheet. But with constant developments in healthcare machinery, assets may depreciate faster than anticipated. This can lead to accounting discrepancies, that could affect tax filing. It is advisable to consult with a qualified accountant who understands how to handle the depreciation of assets within the healthcare industry, to ensure that you are not unfairly taxed for depreciation of assets.

4. Improper Chart of Accounts setup

A chart of accounts (COA) is a tool that businesses use to view complete listings of all accounts at a glance. COAs are beneficial to businesses in that it categorizes accounts for easier tracking. The problem COAs in the healthcare industry is that new clients are constantly loaded into the accounts database and errors in the billing system may feed into inaccurate graphs on the COA. This can make the information that a health provider uses to make business decisions, inaccurate and unreliable. It is imperative that health providers implement accurate billing systems and consult with experts to set up the correct software to help them manage accounts. Getting this wrong can mean a false representation of the financial overview of a health center and lead to incorrect business planning and possible tax recording inconsistencies.

5. Managing bad debts

Bad debts are the bane of every industry’s accounting. It often occurs when businesses do not do thorough due diligence in vetting the clients to which they extend credit, or when a debtor’s financial situation changes. The challenge for the healthcare industry is that they do not always have time to vet clients in need of urgent medical assistance and as such become major targets for bad debts. Unpaid accounts, of course, disrupt the cash flow within a business, putting the healthcare industry at risk for lowered profitability and tax issues, if bad debts aren’t dealt with correctly.

The best way for health providers to manage this is to have an efficient accounts department with reliable accounting software in place to help minimize the occurrence of bad debts. It is advisable to get a professional to implement the right software for your healthcare business that takes into account each of the challenges you might face, and implements methods to mitigate them.

At Fusion, our CPAs can set up software integrations to help alleviate accounting challenges within your healthcare practice and implement a smooth tax filing system for your business.

View this article at a glance, here:

_____________________________________

This blog article is not intended to be the rendering of legal, accounting, tax advice, or other professional services. Articles are based on current or proposed tax rules at the time they are written, and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.