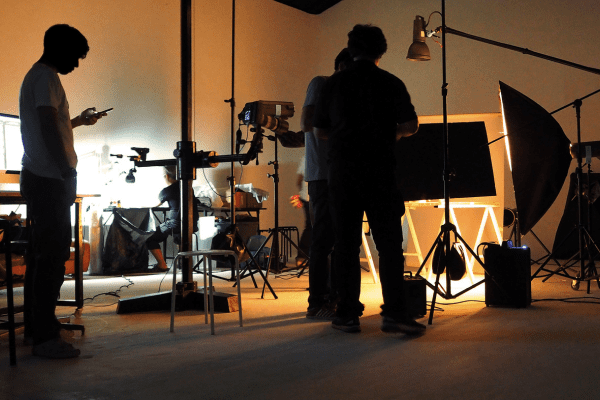

Financial Planning for Seasonal Fluctuations in the Entertainment Industry

As a professional in the entertainment industry, you are typically classified as an independent contractor or gig worker. Here’s what you’ll need for successful financial planning.

Tax Implications of Global Employment for US Businesses

Payroll requirements shift significantly when dealing with tax employment tax obligations. It often introduces dual taxes.

Tax Planning Strategies for E-commerce Sellers

Running an online business isn’t just about generating sales; it also involves managing complex tax obligations that can change based on various factors.

Private Equity Exits: Tax Strategies for Maximizing Returns

Protecting your profits from unnecessary taxes in a private equity exit deal, demands a considered tax strategy.

What is a 13-Week Financial Forecast and Why It Matters for Your Business

The 13-week financial forecast provides a week-by-week breakdown of your company’s cash flow which will equip you to spot potential risks before they escalate.

The Essentials of Dropshipping Tax Compliance

Dropshipping has become a popular business model, thanks to its low upfront costs and scalability. In fact, the global dropshipping market is projected to reach $1 trillion by 2027. Beyond its affordability, entrepreneurs are drawn to its flexibility, as it eliminates the need for inventory management or warehousing. However, dropshipping presents unique compliance challenges. Businesses […]

State Tax Compliance for Remote and Hybrid Workers

Remote or hybrid workers can affect your company’s tax compliance. We want to help you ensure your tax strategy accounts for this.

Understanding SBA Loans: A Deep Dive

Everything you need to know about SBA loans, from eligibility requirements to the right option for your company.

Understanding the IRS’ Increased Use of AI for Tax Compliance

Everything you need to know about the IRS’ use of AI, and how to make sure this move doesn’t negatively impact your tax filings.

Understanding Backup Withholding

Everything you need to know about backup withholding – from its purpose, to compliance, and how to resolve potential issues.