When you’re operating a business that involves manufacturing products or keeping track of inventory, it’s crucial to have a streamlined process that you can use to work with various customers and vendors. This helps increase the productivity and efficiency of your business and ensures that you’re continually moving forward. To aid in this process, it helps to have an efficient manufacturing and inventory management software solution such as Fishbowl.

Fishbowl Inventory lets you keep track of work orders and know the current stage of your products in your manufacturing process. It can also help you identify the number of products available for you to ship to your clients. Fishbowl also integrates with QuickBooks Online, which helps reduce the time you use balancing financial processes such as small business bookkeeping or a small business tax planning and preparation strategy.

Tracking & Costing Your Raw Materials

As a manufacturer, you must purchase raw materials for the products you create. Fishbowl inventory can play an integral part in keeping track of these material receipts. By recording each transaction in the software, you can accurately determine the location and exact cost of each component of your products. You can also use lot and series numbers to find and identify transactions.

You can also use the complied data to record the price for each raw material in your small business bookkeeping. Here at Fusion CPA, our small business accountants can show you how a QuickBooks integration of Fishbowl can seamlessly take the information from the latter and record it correctly and efficiently to the former’s system.

Shipping Your Products Efficiently & Quickly

Whether you’re manufacturing your own products or acquiring goods from a distributor, your main goal is to get each product sold and shipped to your customers. Fishbowl inventory can help you by storing all your financial information in one central database. It lets you manage each order efficiently and pull up each customer’s information individually.

The software also makes it easy to pick, pack, and ship your goods and transfers all of this information over to QuickBooks Online. This accounting integration makes it easier for our experienced small business CPAs to keep track of invoicing records and make sure you get paid. This integration also makes it more efficient when you need to look at income and expenses during a small business tax planning strategy session.

Making Sure Your Vendors & Wholesalers Are Paid

Let’s say you are a bike manufacturer that uses cables, gears, wheels, and a frame to build a bicycle that you sell. The cost of each component will be tracked with its corresponding vendor. This feature makes it easier for our team of small business accountants to ensure that your vendors get paid.

If you’re a merchandiser that does not manufacture its own products, you can still use this feature to track your suppliers. Paying your vendors on time improves your credit rating. Some benefits of a higher credit rating include longer payment terms and lower interests.

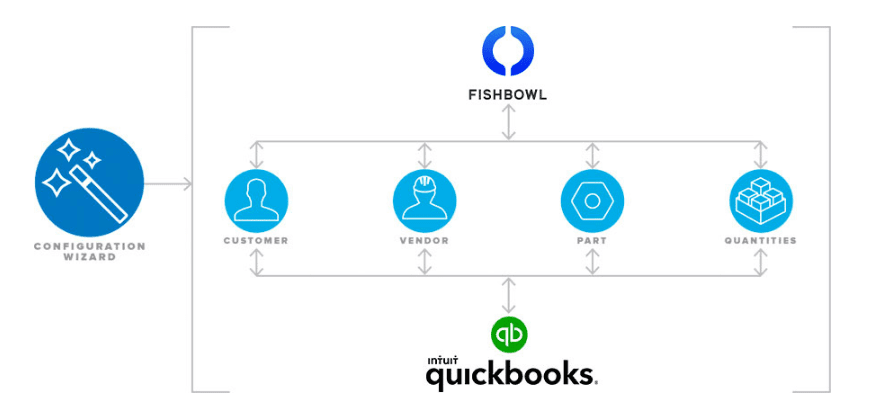

QuickBooks integration with Fishbowl inventory is easy to do. The Accounting Configuration Wizard of FishBowl allows you to import or export the data you need. For example, if you want to account for specific parts you purchased from a vendor, you can export this data from Fishbowl and place it in the appropriate ledger accounts in QuickBooks, such as your Inventory account. There are several other processes you can also import or export, such as pick routing, RMAs, transfer orders, landing costs, dropshipping costs, and many more.

Examine Your Turnover Rates & Forecasting Needs

You don’t want to get caught with a low amount of raw materials or products to sell. Fortunately, Fishbowl inventory provides you with business and financial reports that can help you monitor turnover rates and forecast the need for raw materials in the future. Our team of small business financial advisers, here at Fusion CPA, can assist you with product pricing and handle different aspects of your manufacturing process. Our expert team of small business accountants can also assist you in identifying the acquisition costs of your products from different vendors. These figures can be taken from QuickBooks Online and can be used to determine if there are ways that you can cut costs in specific areas of your business. You can learn more about our services by clicking the button below to schedule a complimentary discovery call today!

This blog article is not intended to be the rendering of legal, accounting, tax advice or other professional services. Articles are based on current or proposed tax rules at the time they are written and older posts are not updated for tax rule changes. We expressly disclaim all liability in regard to actions taken or not taken based on the contents of this blog as well as the use or interpretation of this information. Information provided on this website is not all-inclusive and such information should not be relied upon as being all-inclusive.