We all know that family enterprises blend personal and professional lives. This is exactly why managing interpersonal relationships in family business can be such a challenge.

In this blog, we’ll take a deep dive into the many types of relationships in a family business. We’ll also highlight why these connections are important for business success and longevity.

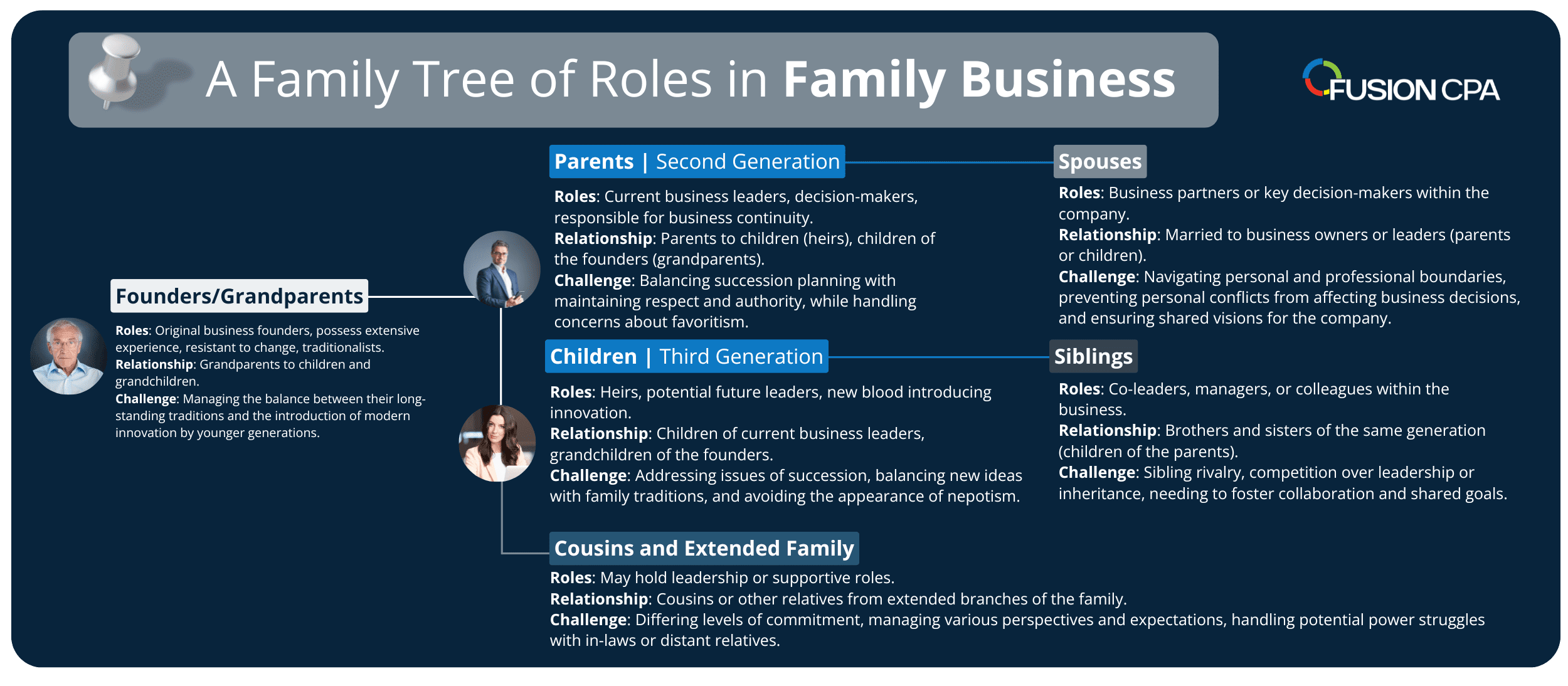

Working with Spouses

Having a significant other as a colleague is a common scenario in these kinds of companies. But it can also be one of the family business’s most difficult interpersonal relationships. After all, spouses differ from blood relations because you choose them. Also, unlike your other family members, there’s an added complexity: romance.

The biggest challenge in working with a spouse is navigating the boundary between the personal and the professional. Private disagreements from outside of the boardroom or unresolved conflicts at home can easily spill over into your workspace. And that has a direct impact on morale and productivity – for both of you, as well as those around you.

Another concern is conflicts around decision-making. If you and your spouse don’t share the same views on strategies or finances, it could lead to delays in decision-making and planning. This is especially true if you don’t have a common leadership style or vision for the company. Without alignment, these differences can create significant tension in your professional life.

But it’s really hard to switch off personal emotions when working with a spouse. So how do you navigate this bumpy terrain?

Tips to ensure you work well together

Just like with any other family member, the key to successful interpersonal relationships in family business is to establish clear roles and boundaries. You need to define, formalize, and document each person’s specific role in your business, according to their skills and strengths. That way, you can prevent anyone from crossing lines or dropping the ball. All in all, this lowers the risk of micromanaging and conflict in the workplace.

Another helpful tip is to set aside time for your personal life. When working with your spouse, managing a work-life balance is essential. Exactly how you do this will depend on your needs, but generally, a starting point is to schedule personal time and stick to designated work hours. These times must be clearly outlined, giving you a chance to check in, see how things are going, and ensure that you’re on the same page.

Finally, working with your spouse means you’ll need to be able to communicate well. Open, honest discussions are vital to resolving conflicts. Make an effort to really listen to one another, and talk about disagreements constructively. That way, you’ll prevent emotions from flaring and getting in the way of business decisions.

Siblings in Business

When you see the words ‘sibling’ and ‘colleague’ together, do you immediately think of sibling rivalry? There’s a reason the phrase is so well-known – it’s a common stumbling block in many interpersonal relationships in family business.

According to some studies, a third of adults describe their relationship with siblings as rivalrous. This ratio increases if they’re in a competitive environment. You may be thinking that a family business isn’t competitive, as you’re all working towards a goal, but that’s not always the case.

If siblings have different visions or motivations (like trying to impress a parent or get a bigger share of the company once the older generation retires), their focus will be on outdoing each other rather than helping your business reach its goals. Not only does that mean a lack of unity in the company, but it can affect relationships with customers and suppliers. That, in turn, affects your bottom line.

Resolving sibling rivalry

The best tool you have at your disposal is to foster a collaborative approach. Shift the focus from competition to collaboration by having the siblings acknowledge each other’s strengths. Teach them to use their skills to complement one another. Instead of searching for faults in each other, brothers and sisters must work on building each other up and finding common ground for shared business objectives.

Along with this, you need a structured approach to conflict resolution. Disputes must be resolved amicably and fairly. If this sounds challenging, you can call in reinforcements.

Contact a professional business advisor or mentor to assist you in navigating interpersonal relationships in family business. These pros can establish structures and practices objectively while focusing on what’s best for your business and family overall.

Parent-Child Dynamics

Bringing the next generation into a family business can be an amazing opportunity. But it can also be a mistake, especially if you’ve been expecting them to take over since they were born, and they’re not interested.

This can be further complicated by concerns of favoritism or nepotism. You may need to justify why you brought your child into the mix over an outside employee or another family member.

And then there are concerns like how to balance tradition with innovation. After all, new blood brings new ideas, although this can create tension if anyone is reluctant to change. Plus you’ll need to consider succession and control. Is your child going to be the future leader of the company, or just another employee?

This brings us to the issue of hierarchy. Maintaining respect in a parent-child relationship can be difficult, especially as your kid takes on more responsibility. It can lead to increased tension at home and work, making it hard to draw boundaries.

Tips for a smooth work relationship

If your child is joining the family business, you need to be absolutely clear on everyone’s expectations from the start. That will help you effectively manage interpersonal relationships in family business. Consider these important questions:

- Why are you bringing them in? Has it always been your vision, or are you worried they won’t be able to find a job and need security?

- What do you expect from them? Their roles and responsibilities must be clearly outlined from the start, along with remuneration and benefits.

- What is your ultimate goal? Do you want your kids to take over the business, and if so, how? Will they buy it or inherit it?

- Is your child the right fit? Do they have the right skills and qualifications for the job, and if not, how do you change that?

When it comes to working with children, we recommend getting a professional mentor or business advisor to equip your team with the tools and skills to do the job, and thrive. They can also help you establish transparent succession plans for when the time comes to change leadership.

Working with Grandparents

If your family business is multi-generational, you’ll know all about the challenges of working with grandparents. It goes beyond wealth transfer and succession planning. Generally, older generations are very resistant to change. Whether that means how decisions are made, how processes are completed, or even the overall mission of your business.

Some older generations may be reluctant to embrace technology, while others may not like a business branching out in service offerings to appeal to a wider market. Or you may face conflicts about the company’s view on risk. Whatever form this resistance to change takes, it has to be addressed.

Easing the tensions

Older generations have one thing in abundance: experience. After being part of the company for many years, they know exactly what’s happening. It’s important to respect this experience, and acknowledge their contributions. When introducing change, this needs to be done diplomatically, through regular communication. For instance, you could highlight how innovation can complement the stable foundation they built. This means you’ll need structured decision-making processes, such as forming a family council or an external advisory board.

Regular communication and fostering mutual understanding are key to balancing both perspectives and creating winning interpersonal relationships in family business. Successful multigenerational collaboration requires mutual respect and the ability to blend time-tested traditions with modern business innovations.

Cousins and Extended Family

Working with cousins and extended family can present unique problems, especially when it comes to managing different perspectives and expectations.

For example, these family members could lead to differences of opinion over values and priorities, especially if they don’t have the same level of commitment as immediate relations. Working out roles, responsibilities, and succession can be tricky in extended family dynamics. After all, there could be disagreements about who should take on leadership roles, especially if multiple branches of the family are involved.

This extends to in-laws. Because these relations are through marriage and not blood, they can sometimes lead to power struggles, and difficulties in establishing clear roles. Your in-laws might even feel like outsiders. Additionally, long-standing family tensions or business conflicts can exacerbate the situation if not properly managed.

To prevent these issues from becoming unmanageable, you need clear communication and collaboration. That extends to what’s expected of different roles, and how conflicts should be resolved.

You’ll also need structured onboarding and integration plans for bringing these family members into the business, along with a clear code of conduct for all employees. This will help everyone understand the business’ culture, values and goals, for mutual respect.

Working with family can be a blessing. But without the right systems in place, navigating interpersonal relationships in family business can be a headache. For help avoiding the issues mentioned in this blog, or for assistance with your business’ accounting and tax obligations, schedule a Discovery Call with one of our team. We want your business to thrive, without unnecessary stress.

The information presented in this blog article is provided for informational purposes only. The information does not constitute legal, accounting, tax advice, or other professional services. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Use the information at your own risk. We disclaim all liability for any actions taken or not taken based on the contents of this blog. The use or interpretation of this information is solely at your discretion. For full guidance, consult with qualified professionals in the relevant fields.