Texas is a very attractive state for individuals, as it has no individual income tax. However, businesses are subject to a 6.25% corporate income tax rate.

Understanding the cost of apportionment in the state can help you accurately report earnings to the IRS and local government.

Corporations & Partnerships

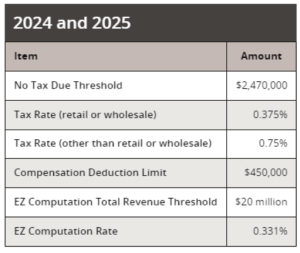

- Filing Requirements. S Corps and Partnerships are subject to franchise tax. Franchise tax rates, thresholds and deduction limits vary by report year.

- Allocation and Apportionment. Texas follows the single-factor rule in sourcing receipts from the performance of services to the state.

Employees & individual filers

Texas does not impose personal income tax.

Download our Multi-State Tax Filing Requirements Guide

Ensuring Accurate Tax Filings

Consulting an expert CPA can help you keep a handle on different laws and tax implications.

Fusion CPA has a team of certified public accountants who are highly skilled in handling multi state taxes. We’re positioned to help you take the stress out of tax season, so you can focus on what really matters.

To see how we can help you with a proactive tax strategy to save you time and money, schedule A Discovery Call with one of our CPAs.

The information presented in this blog article is provided for informational purposes only. The information does not constitute legal, accounting, tax advice, or other professional services. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability, or availability of the information contained herein. Use the information at your own risk. We disclaim all liability for any actions taken or not taken based on the contents of this blog. The use or interpretation of this information is solely at your discretion. For full guidance, consult with qualified professionals in the relevant fields.